It's pretty maddening to hear Bill Ralston mischaracterise everything that's happened in the past week, claiming that Cullen and Bollard are sitting on their hands and oblivious to the impending economic meltdown.

Did Ralston read the same piece that I did? Cullen all but announced a massive spending spree next year. It doesn't take much reading between the lines:

In summary, the global economy is facing considerable uncertainty, the US is facing significant challenges, while consumers globally are feeling real pain as a result of rising living costs...

Our low-debt, strong surplus fiscal policy helps to lessen the impact of global shocks and gives us more options in formulating a response if the situation deteriorates.”

By “more options”, he's talking about a few billion dollars worth of options. But those options won't be exercised until the picture becomes clearer. He's allaying fears with the promise that if the global situation doesn't improve, the government will step in with a fiscal response, backed by low-debt and big surpluses.

And lo! The final phase of Cullen's master plan will be complete.

It hasn't exactly been a secret. The stacks of surpluses were all building up to this, and while nobody predicted the US subprime crisis, a downturn was always inevitable. From the 2006 Budget:

Cash deficits are forecast of $1.5 billion for 2006/07, $2.1 billion for 2007/08, $2.7 billion for 2008/09, and $1.1 billion for 2009/10, in all some $7.4 billion over the period...

This Government does not intend to react to this situation by slashing government expenditure, thus making the slowdown worse. The fiscal prudence adopted over the previous six years, in other words allowing the automatic stabilisers to work on the upside, means they can now be allowed to work on the downside. This contrasts with the position in 1999 when the previous Government reacted to a downturn by such moves as cutting the level of New Zealand Superannuation.”

(Translation: The downturn is coming, and the government can and will run a deficit, pumping money back into the slowing economy in the same way that it's been taking money out.)

And now, this is the exact same line that Cullen is running.

This is not, by any stretch of the imagination, some kind of coincidence, or an excuse that Cullen is exploiting to break the bank. This – buffering the economy from global shocks by stimulating it with a massive injection – is precisely why he was maintaining the surplus in the first place.

Sure, he's been aided by fine economic weather, and perhaps he's dipped into the bank more than he should have these last few years, but the bottom line is that after eight years, he has genuinely left the government in a strong position to respond.

Now, finally, everyone can STFU about the goddamn surplus, and focus on the kind of response required, which depends on events in other parts of the world, which remains unclear. The risk of acting before the facts are in? From the Herald:

If you react to downside risks to growth at this point, and those risks don't eventuate, then you are going to have a horrible inflation picture facing you over the next couple of years. It's pretty horrible already," says [Deutsche Bank chief economist Darren] Gibbs.

“If things do turn out to be weaker over the next six months, [Cullen] can come to the rescue and deliver $2b or $2.5b worth of tax cuts.”

(Translation: If you spend like there's going to be a recession when there isn't one, inflation will get nasty.)

--

And as Bill English points out, inflation is already nasty, and he places the blame on the government's spending spree over the past few years.

Thankfully, Key and English haven't joined Ralston's “let's panic some” school of economics. English is, instead, focused on the inflationary pressures caused by the Government's spending. If this holds, the days of inane surplus-bashing is over. Hallelujah!

Entrail-reading for a moment, I'm guessing that National is positioning themselves for the argument that tax cuts are less inflationary than direct government spending, and that they'll offer up a fiscal stimulus package with a much larger tax cut component (with less spending), then argue that it's more money in the pocket and less inflationary.

However, tax cuts are less inflationary because some of it is saved, and some of it goes on buying stuff from overseas – which kinda defeats the purpose of a fiscal stimulus package. But hey, let's cross that bridge when we get to it.

--

This part of the coming election is becoming clear now. There will be a spending spree, and there will be a lot of effort to portray the spending spree next year as, oh, I don't know, “the last ditch attempt by a tired, directionless government desperately trying to hang on to power”, that sort of thing.

But is it? It's undeniably convenient for the government that a global recession is looming on the eve of an election. Not only can they spend big with a good conscience, with fewer inflationary pressures from overseas, but they (well, Cullen) can simultaneously blame America for the global woes and tsk tsk their right-wing economic policies.

I think we can give Cullen the benefit of the doubt and assume that he didn't engineer the subprime crisis, but the Government hasn't found itself in this position by chance, either. Cullen has spent almost a decade resisting the political pressure to splurge – with mixed success – but he has ultimately emerged from the other side intact.

It may still fail miserably, or even spectacularly, but succeed or fail, this will be Cullen's master plan, carried out in full. It won't be simple opportunism or the panicked flailing of the arms. If anything, this is the only part of this Government which still has a strong sense of direction and purpose.

It's also a reflection of Cullen's own theoretical and ideological leanings, so the outcome will vindicate or indict the ideas, along with the man.

The next budget is going to be bloody interesting.

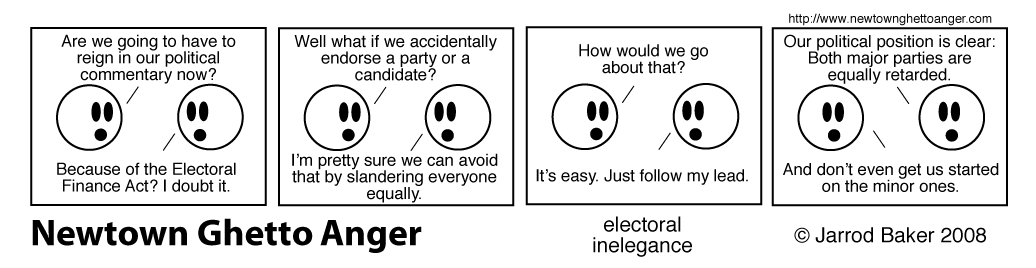

Click here for more NGA.